As the insurance industry continues to evolve, embracing new technologies is no longer optional but a necessity. Among ...

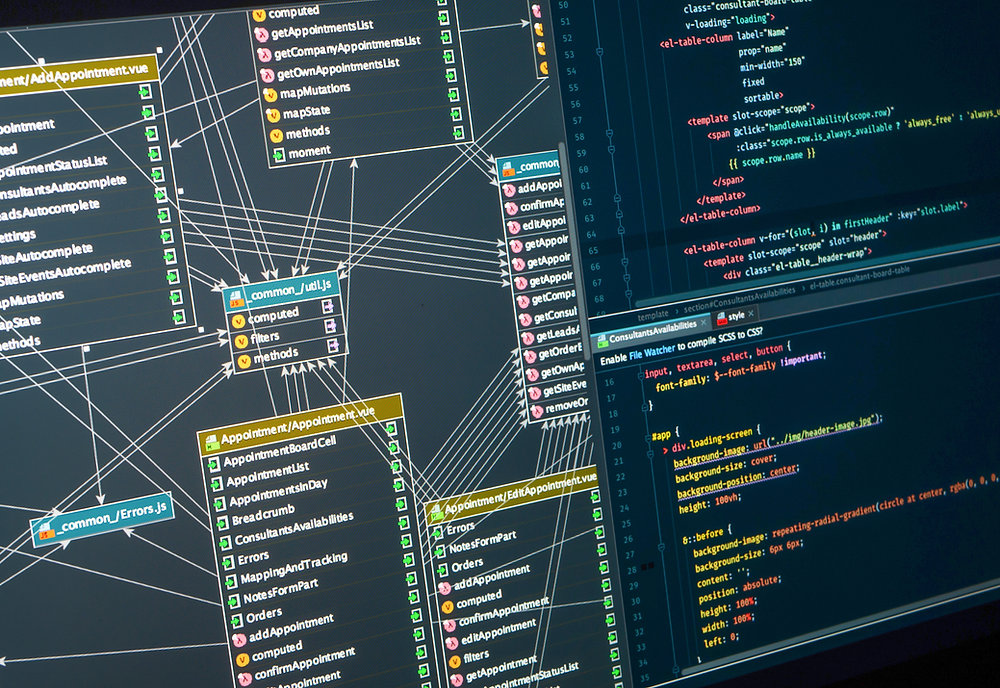

Read moreUnderstanding the System Components:

Best Practices for Designing System Architecture:

Planning and Research

The first step in designing the system architecture for an insurance comparison service is to conduct thorough planning and research. This includes analyzing the needs of the target market and any existing insurance comparison services and their systems. This research will provide valuable insights into what works well and what can be improved.

When designing the system architecture for an insurance comparison service, it is important to define the key components of the system in order to ensure that all necessary elements are included. Some of the different components that are required include:

-

Data Management: Data management is a critical component of the system architecture, as it is responsible for organizing and storing the information required for the insurance comparison process. This includes policy details, pricing, and other relevant information. The data management system should be robust, secure, and efficient to ensure that data is accessible and up-to-date at all times.

-

User Interface: The user interface is the main point of interaction between the insurance comparison service and the user. The interface must be easy to use, intuitive, and visually appealing to ensure that users can find the information they need and make informed decisions about their insurance coverage.

-

Comparison Engine: The comparison engine is the core component of the insurance comparison service and is responsible for comparing different insurance options based on the user's criteria. This component should be designed to be fast, accurate, and reliable to ensure that users can find the best coverage at an affordable price.

-

Payment Processing: To purchase insurance coverage through the comparison service, users will need to be able to make payments. The payment processing component should be secure, reliable, and easy to use to ensure users can complete transactions quickly and easily.

-

Customer Service: A customer service component is essential if users have questions or need support. This component should be accessible and responsive, providing users with the information and assistance they need to resolve any issues.

-

You can create an effective, efficient, and user-friendly comprehensive insurance comparison service by defining these critical components and ensuring they are included in the system architecture.

Implementing Data Management

Focusing on User Experience

The user experience is an important factor in the success of any insurance comparison service. The system architecture should be designed with the user in mind, making it easy to use and accessible for all. This includes clear and concise information about insurance options and an intuitive and user-friendly interface.

Ensuring Scalability:

-

Load Balancing: One way to ensure scalability is to implement load balancing, which distributes incoming requests evenly across multiple servers, reducing the risk of overloading any single server. This helps to ensure that the system remains responsive even as the number of users grows.

-

Cloud Computing: Another way to ensure scalability is to utilize cloud computing resources, such as Amazon Web Services or Microsoft Azure. This allows the system to take advantage of the scalability and resources offered by these platforms, reducing the need for additional hardware and infrastructure investments.

-

Automated Scaling: Automated scaling can also ensure scalability by automatically adjusting the number of resources (such as servers or virtual machines) based on demand. This helps to ensure that the system can always handle the workload without having to manage resources manually.

-

Monitoring and Analytics: Monitoring and analytics are also crucial for ensuring scalability, as they provide insight into the system's performance, allowing you to identify potential bottlenecks or areas for improvement. By continuously monitoring the system, you can make adjustments to ensure that it remains responsive and efficient even as the number of users grows.

.webp)

-3.webp)