Blog

Latest updates & insights

At CoverKraft, we believe in empowering insurers with innovative solutions that transform the insurance landscape. Our Consumption-Based feature introduces a game-changing approach to insurance pricing by leveraging data from trackers and health apps. This enables insurers to craft personalized and fair insurance plans based on real user behavior, promoting transparency and accuracy in premium calculations.

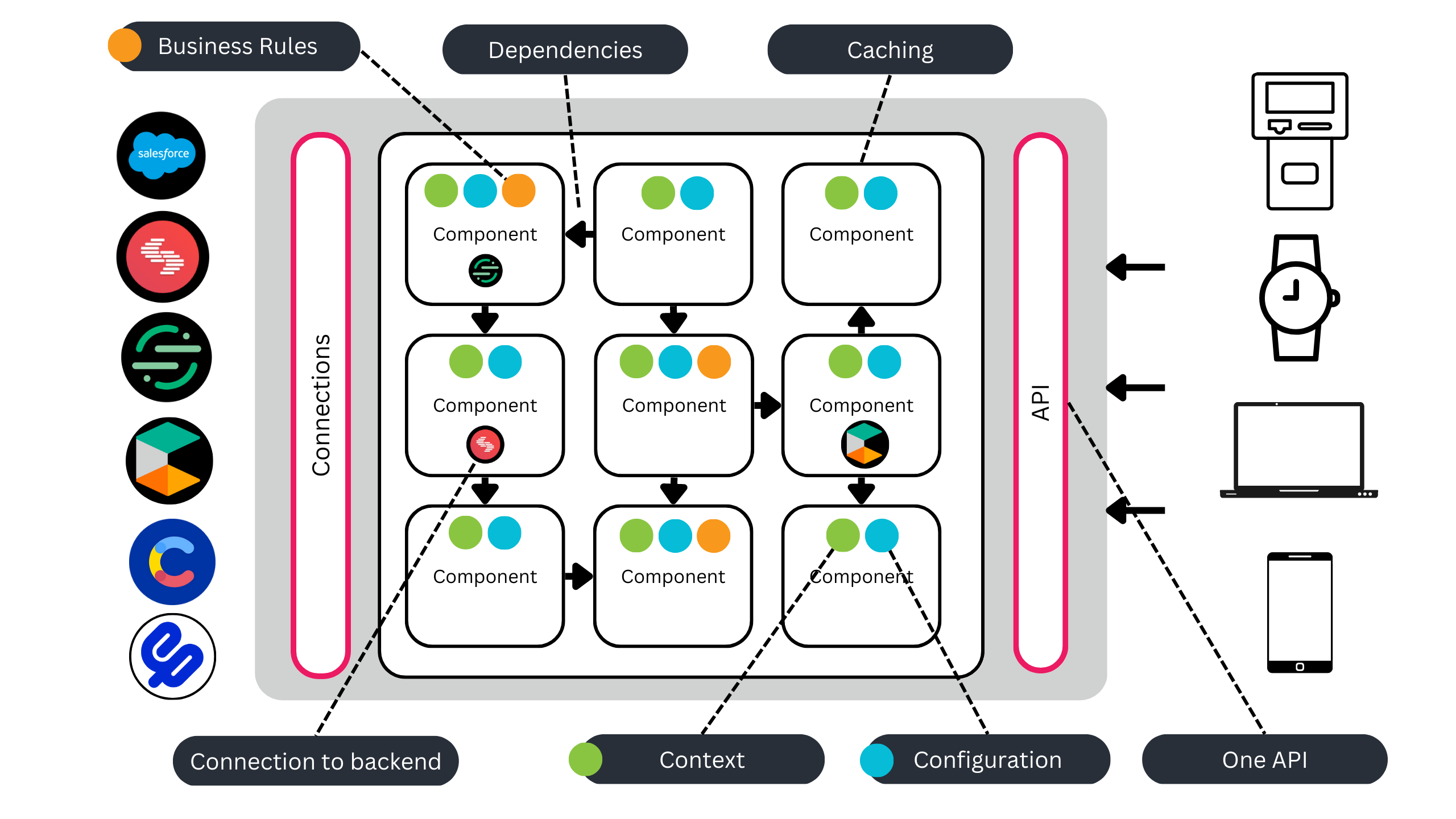

On this page, we'll explore how this feature works, the benefits it offers, and the role of our seamless API integration. By pulling data from various systems—such as SmartPhone Health Apps, Watch Trackers, and mobile phone apps for mileage and GPS—our platform ensures real-time access to accurate and relevant information. This integration enhances customer experience and equips insurers with valuable insights to make data-driven decisions.

-1.png)

-1.png)

-1.png)

.png)

.png)

Our API integration plays a crucial role in enabling the seamless retrieval of data from various systems. By pulling data from SmartPhone Health Apps, Watch Trackers, and mobile phone apps for mileage and GPS, our platform ensures real-time access to accurate and relevant information. This integration enriches the customer experience and empowers insurers to make data-driven decisions

You can check your audience activity by click data above. You can access on apps too and website with your Ehya Account.

Your competitors are already embracing the power of low-code technology.